App Description Page

Advance Credit Check Rules

This application provides functionality to configure advance credit check rules and apply on customer, such as:

1) Credit Hold (all new sales orders require accounting department approval).

2) Check for balances 30 days or greater past due if no past due, then no approval needed on any amount -- even if it exceeds credit limit.

3) If any balance is 60 days due, then approval required otherwise no approval unless order exceeds credit limit.

4) Check for balances 60 days or greater past due if not past due, then no approval needed on any amount -- even if it exceeds credit limit.

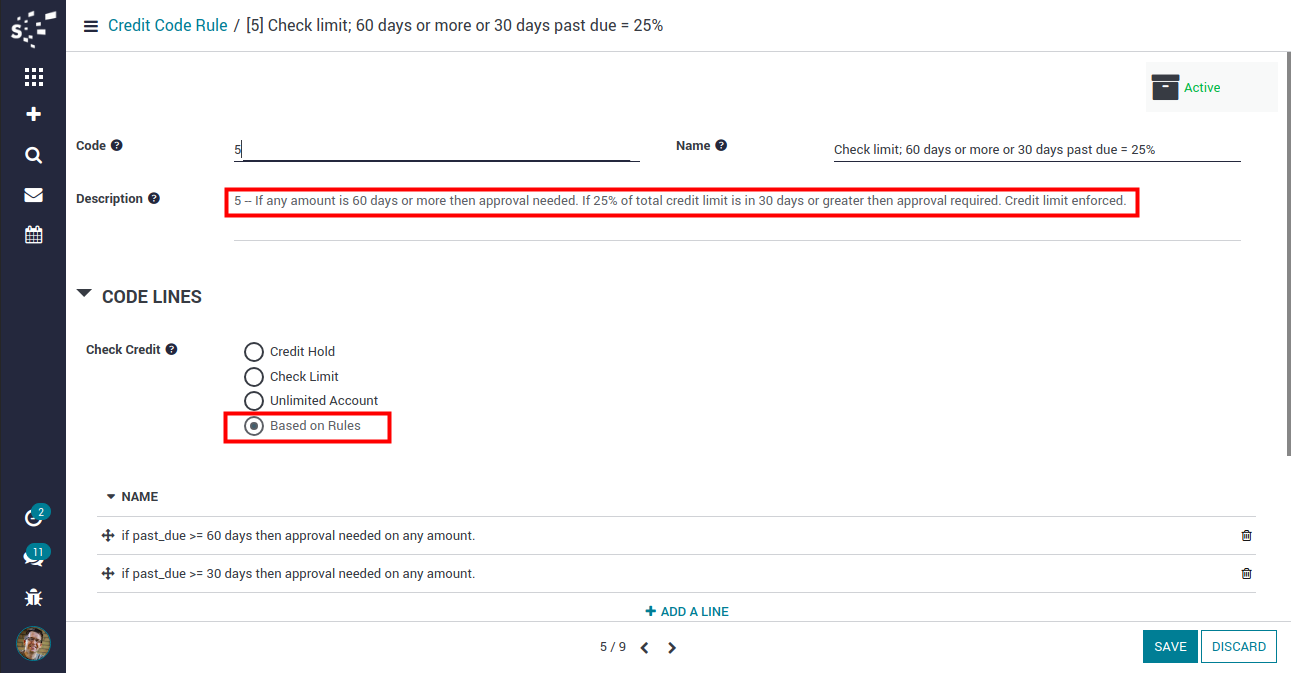

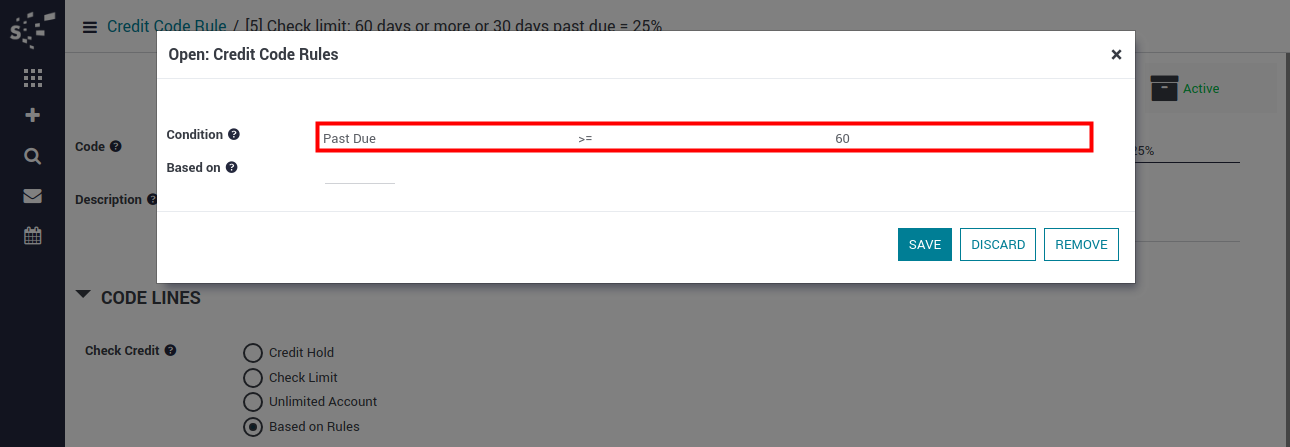

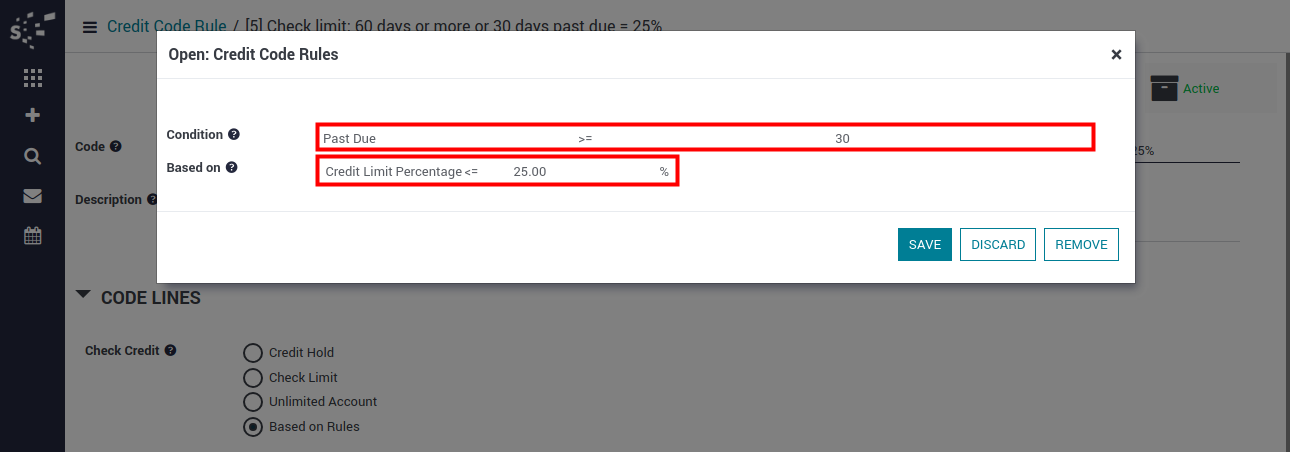

5) If any amount is 60 days or more then approval needed. If 25% of total credit limit is in 30 days or greater then approval required. Credit limit enforced.

6) If any amount is 60 days or more then approval needed. If balance in 30 days is greater than $500 then approval required. If ANY balance is 60 days or greater approval required. Otherwise credit limit is not checked.

7) Unlimited account has no credit restrictions (even if their credit limit is exceeded).

This module is compatible with.

-

Community

-

Enterprise

-

Odoo.sh

Key Features

- Allows to configure advance credit check rules and apply on customer.

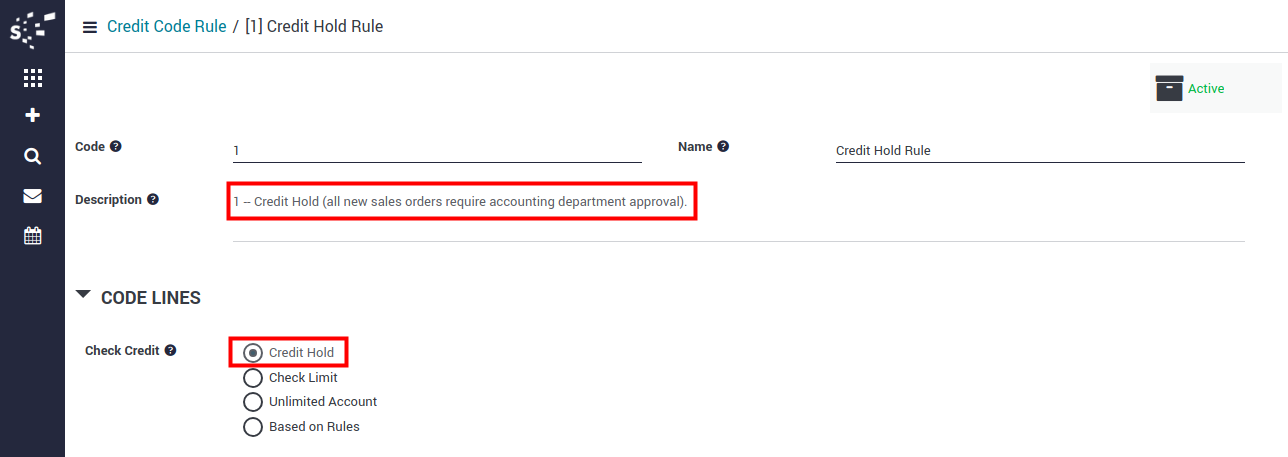

Create Credit Code Rules

- 1) Credit Hold: All new sales orders require accounting department approval.

- 2) Check Limit: Check credit limit assign on customer.

- 3) Unlimited Account: No credit restrictions (even if their credit limit is exceeded).

- 4) Based on Rules: Dynamic rules can be define to check credit limit.

Configuration Based on Rule

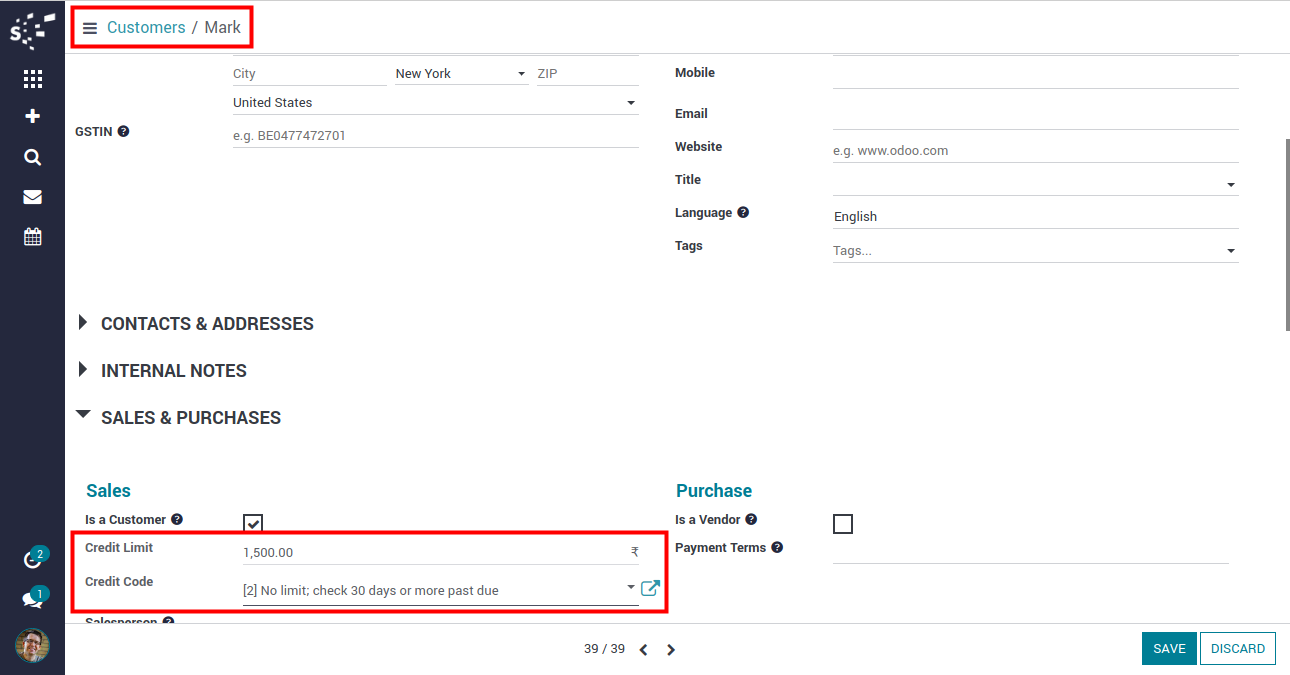

Configuration on Customer

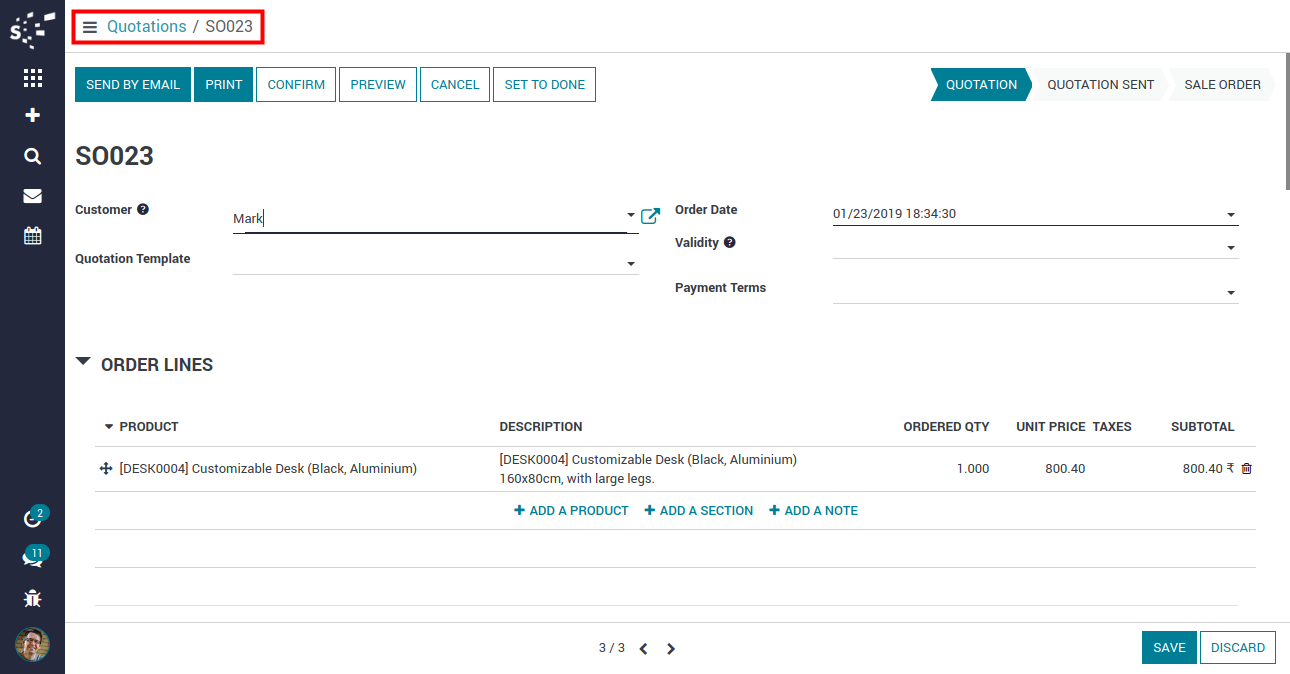

Create Sale Order

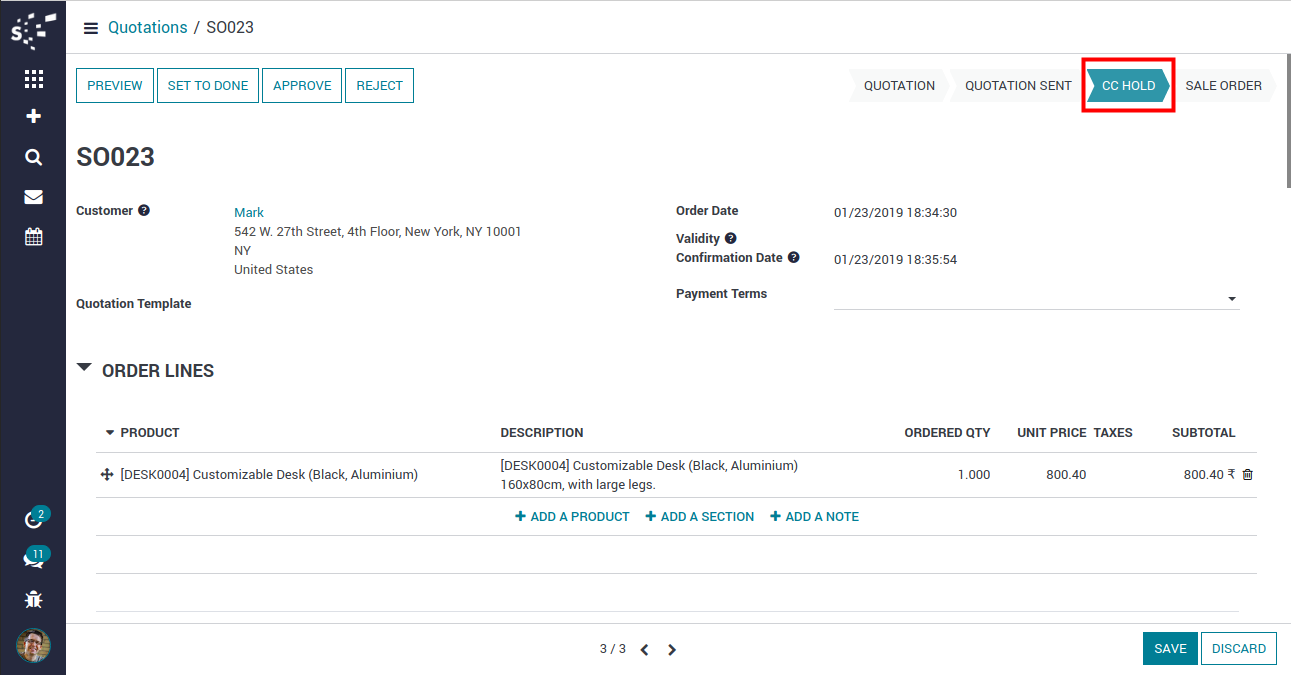

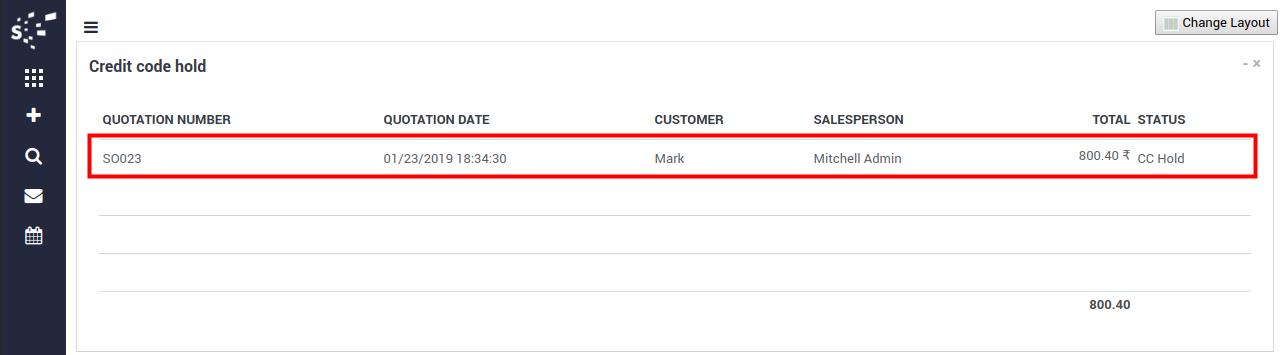

Credit Code Hold

Credit hold order on Dashboard

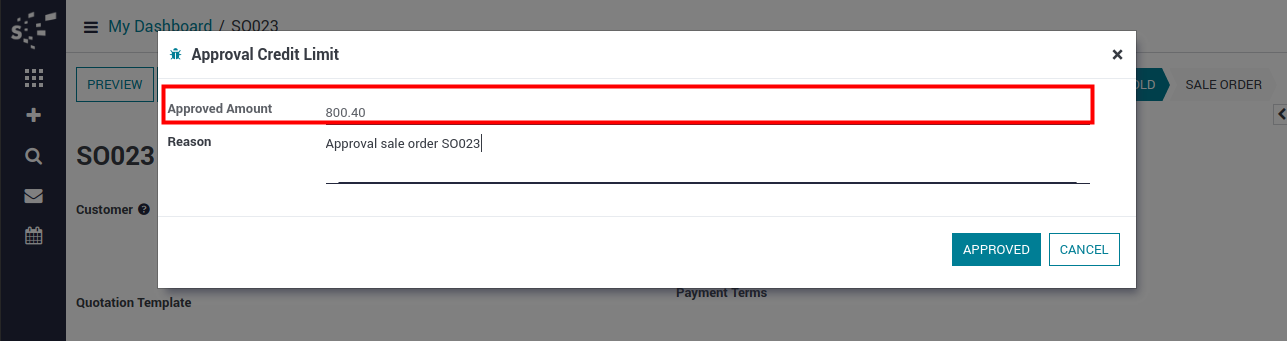

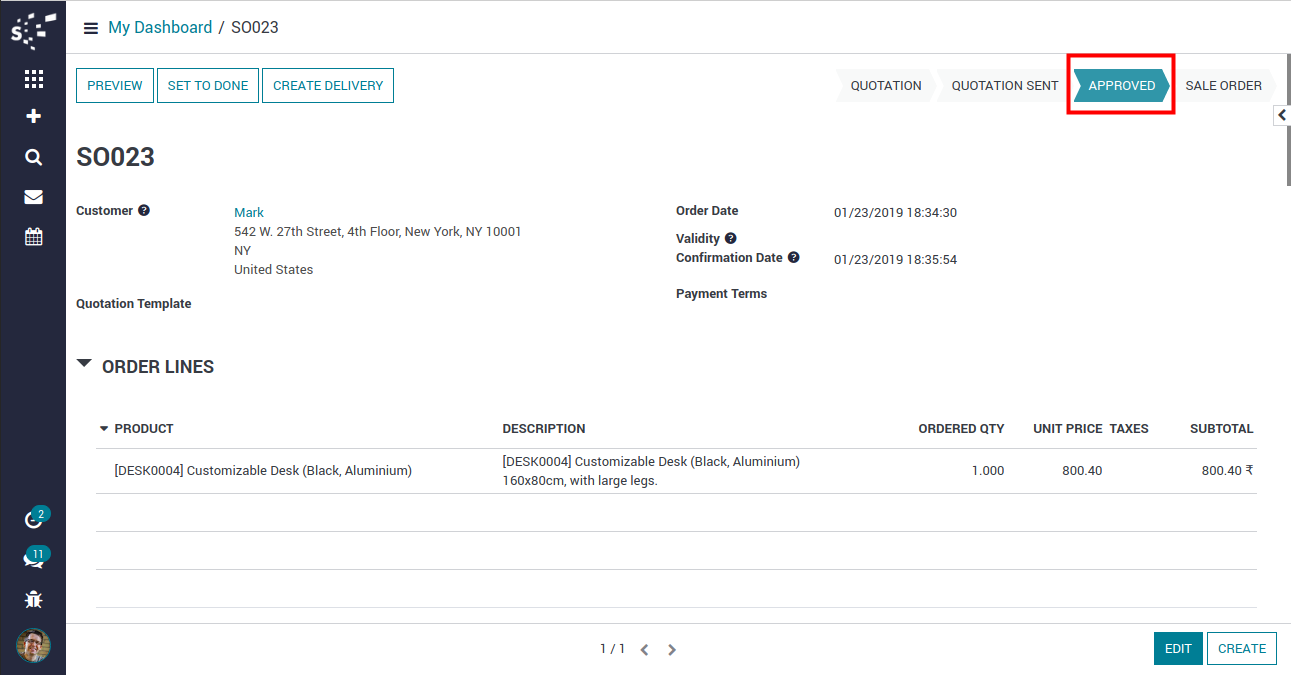

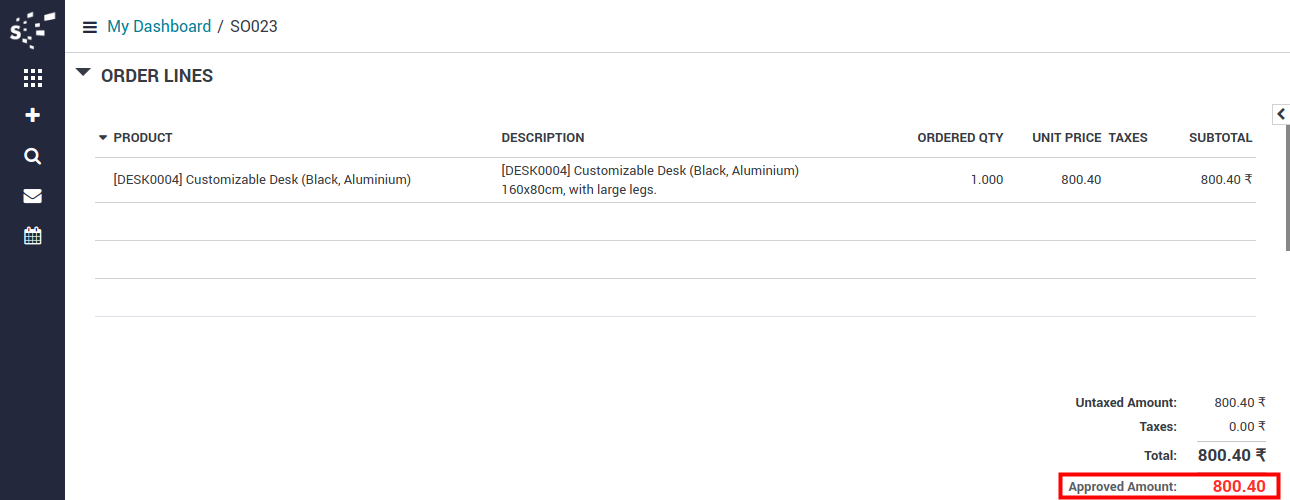

Approved Order

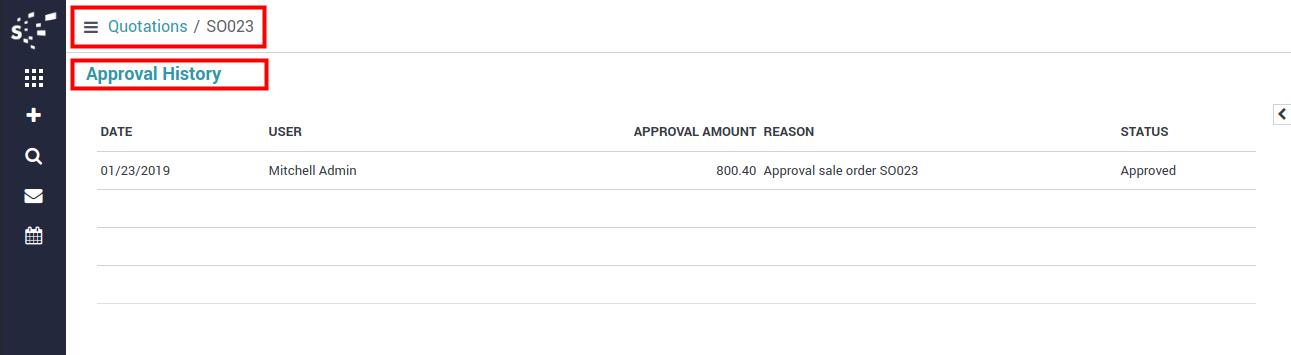

Approval History

Notes:

- All the apps are to be purchased separately, for individual versions and individual edition.

- One month free bug support period will be offered pertaining to any one server used, testing or live.

- Synconics is only responsible for providing the module zip file on your registered email, purchased from our app store or directly through our company.

- Synconics is not responsible for installation or updating of the module on any of your server.

- If an error appears in our app due to other custom modules installed in your system or if Odoo base source code is not updated on your system, to make it compatible with your source code, we'll charge you for our efforts to resolve those errors and make the module compatible with your source code.

- Please refer the document for configuration. If any support is needed for module configuration, installation, updating or any help is needed, it will be considered in paid support.

- Please note that you are not allowed to distribute or resell this module after purchase.

- This module is tested and working on Odoo vanilla with Ubuntu OS.

- Support services will be provided from Monday to Friday, 10:30 AM to 7:30 PM IST (Indian Standard Time).

- Support will not be provided during Indian public holidays or company holidays.

Once the user has seen at least one product this snippet will be visible.